Hmm…must be that time of year, or something.. Anyway – European bankers are gearing up for another stress test. Yes, their third. But, hey! This time they promise to get it right. The ECB has even hired the best external stress tester in the business to do the job. US-based financial consultancy firm Oliver Wyman, a company who has a proven track record for coming up with the right numbers. However, not always the most accurate ones.

“This is the last opportunity to reestablish confidence in the European banking system.”

Stress testing of European banks is actually one of the most entertaining parts of the financial crisis. It’s almost hilariously funny to watch the troubled bankers desperately trying to cork a swiss cheese with a soft gun – the holes just multiply and keeps getting bigger.

For every “the worst is over” statement, the laughter grows… We’ve gone from booing to cheering…

For every “the worst is over” statement, the laughter grows… We’ve gone from booing to cheering…

And the preparations for stress test #3 are also promising.

Last week the ECB announced that it had hired the US-based consultancy firm, Oliver Wyman, to conduct the test. These guys are no strangers to the European stress testing.

- In 2006, it famously said the Anglo-Irish Bank was the best bank in the world. Three years later, the bank had to be nationalised and almost bankrupted the Irish state, which then needed a euro zone bailout.

- In 2012, during the Spanish bank bailout, Oliver Wyman provided the euro zone decision-makers with the numbers they expected and which were politically acceptable – around €60 billion instead of a much larger gap that the banks actually had.

- Also 2012, Oliver Wyman did consultancy work in the Portuguese bailout, according to the central bank of Portugal.

The EU observer writes:

“The worry in euro zone central banks, according to one insider, is that if banks are reviewed too thoroughly and their problems exposed, they will stop lending and revive the financial crisis.”

Thanks for carving it out, but I think we kinda guessed that already.

Thanks for carving it out, but I think we kinda guessed that already.

But there’s another factor in play this time.

You see, the ECB is planning to step up to the role as EU’s chief supervisor next year and I believe they want to know what they’re supposed to supervise.

The ECB plans to put 130 major European banks to the test before it assumes regulatory supervision of the institutions in the fall of 2014.

The ECB plans to put 130 major European banks to the test before it assumes regulatory supervision of the institutions in the fall of 2014.

“This test is not a threat,” says Jörg Asmussen, former state secretary in the German Finance Ministry, now a member of the executive board of the European Central Bank (ECB).

“But after two failed stress tests, this is the last opportunity to reestablish confidence in the European banking system.”

I’m sorry, but I think that ship sailed the moment you signed the deal with Oliver Wyman, Mr. Asmussen.

I’m sorry, but I think that ship sailed the moment you signed the deal with Oliver Wyman, Mr. Asmussen.

Additionally, many substantial estimates have already been made over the potential magnitude of the gaps the test will uncover.

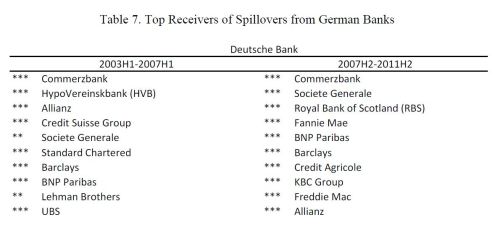

SPIEGEL Online reports that Deutsche Bank estimates that Europe’s banks will need €16 billion in additional capital. Depending on which criteria the ECB applies in its tests, the gap could be much bigger.

SPIEGEL Online reports that Deutsche Bank estimates that Europe’s banks will need €16 billion in additional capital. Depending on which criteria the ECB applies in its tests, the gap could be much bigger.

The Bundesbank, Germany’s central bank, has just estimated that the seven largest German banks alone need an additional €43 billion in capital to satisfy the new international capital requirements.

I don’t think any stress test dares to go higher than that!

I don’t think any stress test dares to go higher than that!

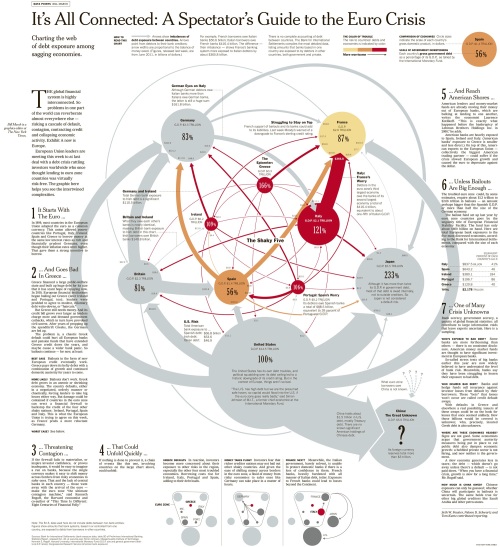

A comparison with the United States gives indications on how bad shape the Europeans really are in.

US financial groups are reporting record profits, while banks in the euro zone have lost more than €80 billion ($108 billion) in the last two years. In the United States, 10 times as many ailing banks were closed and balance sheets were more consistently relieved of bad debt than in the euro zone.

The European leaders seem to have failed to adequately address their banking crisis.

But they won’t give up!

So, what can we expect in the next 8 to 10 months?

My guess is – for what it’s worth – is that we will see a slow, dramatic build-up. with ECB’ers and politicians lining up to give their pledges about the truth and nothing but the truth, followed by a series of suspicious leaks, causing some market turmoil and a little bit of liquidity squeeze, and by this time next year the ECB will take on the European banking supervision with a huge off-balance sheet and the uncertainty of the euro zone bank sector will be unchanged.

My guess is – for what it’s worth – is that we will see a slow, dramatic build-up. with ECB’ers and politicians lining up to give their pledges about the truth and nothing but the truth, followed by a series of suspicious leaks, causing some market turmoil and a little bit of liquidity squeeze, and by this time next year the ECB will take on the European banking supervision with a huge off-balance sheet and the uncertainty of the euro zone bank sector will be unchanged.

And finally we start all over again with stress test #4.

We can party for ever!

Full history of European bank stress testing:

- Yippee! Another European Stress Test Festival!

- The EU Stress Test: Working The Media

- Weekly Outlook: The European Post Stress Test Syndrome

- EU Bank Stress Test: Commentaries & Market Reactions

- EU Bank Stress Test: Here’s The Full Package

- To Europe From Goldman Sachs On The Stress Test Eve

- Financial Authorities See No Point In Stress Testing Norwegian Banks

- Norway: Most Banks Fail In Stresstest

- All Nordic Banks Will Pass Stress Test, Nordea Says

- European Bank Stress Tests Are Loosing Credibility

- EU Stress Test May Trigger Capital Injection Of EUR 85 Billion

- Global Markets Mental Health Test

Other articles:

- ECB hires firm that said Anglo was world’s best Bank to stress test EU banks (politics.ie)

- National backstops expected to be in place for European banking stress tests – Draghi (irishtimes.com)

- CORRECTED-ECB’s Asmussen: ESM needs rule change to be used as resolution backstop (xe.com)

- ECB Policy Makers Say Stress Tests Risk Market Confusion (bloomberg.com)

- Draghi Warns Banks Long-Term Loans Can’t Replace Capital (bloomberg.com)